About Calvin Capital

We are driven to do the best job possible. We pride ourselves on cultivating lasting client relationships built on trust and mutual respect.

Founded in South Florida in 2021, Calvin Capital is a leading provider of Digital Asset and Defi exposure. We provide a secure way to invest in cryptocurrency assets and DeFi networks that are systematically traded by millions of individuals, institutions, and funds.

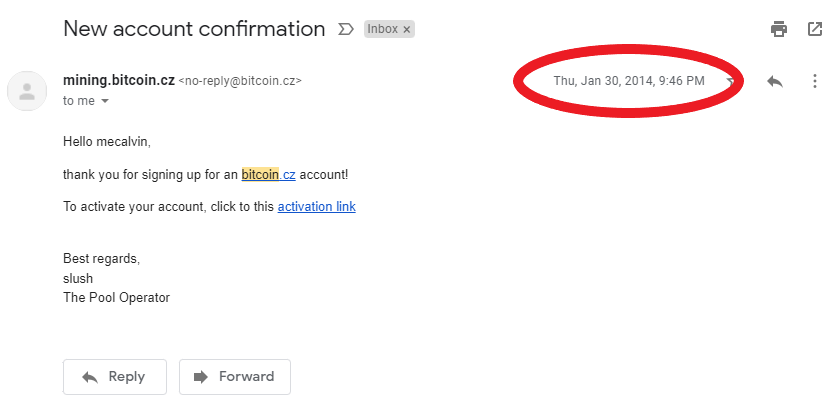

Our founders have years of investing in Bitcoin and other Altcoins with a recent focus on the ever expanding and undervalued Cosmos ecosystem. Mr. Calvin has been involved in Bitcoin since early 2014 and therefore was able to spot one of the best speculative investments of this century long before the vast majority of people including most professional funds & traders.

Our clients include many of the world’s best-performing and most admired companies, law enforcement officers, first responders, and various professionals that were looking to gain exposure to one of the hottest and most lucrative asset classes of this century.

Minimum Investment

AUM

Target ROI

Involved in Bitcoin since early 2014

Professional Digital Asset Management

Calvin Capital “CC” offers individuals (investors) exposure to a portfolio of digital assets systematically managed by highly-experienced managers, traders and analysts in the crypto space. The services offered by CC provides exposure to digital assets through a safe & secure investment, providing individual accounts for each and every investor.

CC believes a passive stake & liquidity pool strategy can pose undue market risk considering the extremely volatile nature of digital asset markets. Investment of all or a portion of such digital asset holdings in liquidity pools that are actively managed by CC’s dedicated team of experienced professionals, offers a more attractive risk alternative to holding significant ETH or BTC.